From agupdate.com:

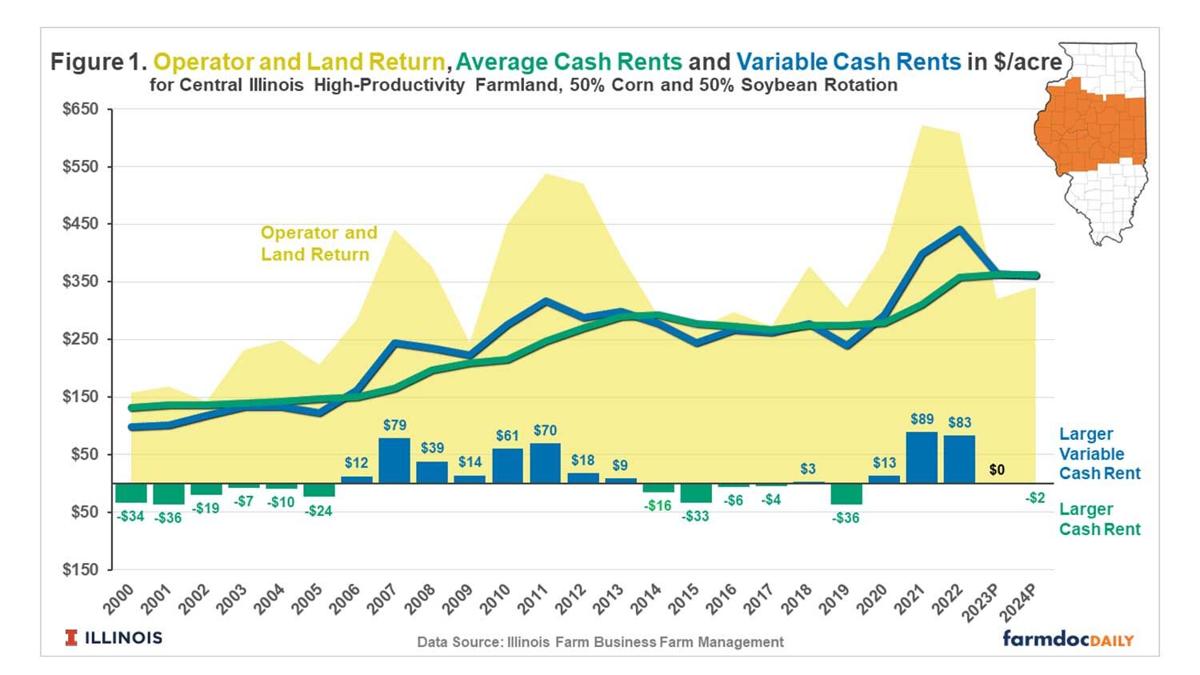

Recent crop budget and return projections for the 2023 and 2024 crop years show the potential for much lower, and potentially negative, returns to corn and soybeans across Illinois.

Lower corn and soybean prices in 2023 and 2024 lead to lower returns than in 2020 to 2022, despite some declines in fertilizer costs. Production costs remain high, such that break-even prices are near $5 per bushel for corn and $12 per bushel for soybeans for 2024, assuming trend yields.

Reducing land costs, specifically rental rates, often is needed during periods of lower returns. Fixed cash rent leases, where the farmer pays the landowner a fixed rental rate, can be difficult to re-negotiate to lower levels. Traditional share rent leases provide natural risk sharing between the farmer tenant and landlord but require more intensive management by the landlord and more coordination between both parties.

The variable cash lease has been suggested as a sort of middle-ground approach that provides risk-sharing benefits while also minimizing the management requirements for the landlord.

Graphic courtesy University of Illinois farmdoc daily

Today’s article provides a historical comparison of the fixed cash, variable cash and share lease designs.

The variable cash lease adjusts to fluctuating revenue levels, however, the traditional share lease is more highly correlated with returns since it incorporates both revenues and direct costs in rental determination.

Projections for the 2023 and 2024 crop years are for negative farmer returns under both fixed and variable cash leases, but modest positive farmer returns under a traditional 50/50 share agreement.